FY24/25 Q2 Australian eCommerce Benchmarking Data

2 January 2025 Blog Posts

Megantic’s Benchmark Report shows which industry niches are growing, and how your organisation can set realistic growth targets.

Read on for quarterly trends and the latest benchmarking data for FY25 Q2, analysing over 100 Megantic Clients from 6 different industry niches.

How to Use Megantic’s eCommerce Benchmarking Data

We have reviewed internal data for over 100 Megantic clients in key verticals and focused on three main metrics of performance:

Click-Through Rate (CTR): The percentage of users who clicked on an organic Google Search result after seeing it in the search results (SERPs).

Cart-to-View Rate (CTV): The percentage of users who added a product to their cart out of those who viewed the product page.

Conversion Rate (CR): The percentage of website visitors who completed a purchase.

These benchmarks highlight strengths and improvement areas in your organic search strategy, helping you make data-driven decisions to boost conversions.

Understanding these trends highlights the importance of benchmarking, comparing performance across different periods to identify what strategies work best.

Monthly Trends – Average data across all verticals

Raising no eyebrows, December emerged as the strongest month when averaged across the eCommerce funnel metrics and demonstrated a click-through rate of 2.56%, a cart-to-view rate of 11.22% and a conversion rate of 2.19%. The notable difference between November and December in total online retail sales is due to seasonal factors.

Megantic clients are encouraged to maintain promotions over Black Friday, Cyber Monday, and Boxing Day, as the surge in online retail driven by these holidays remains on trend.

The seasonal shopping trends are best explained by the Australian Bureau of Statistics in their research report into Retail Trade in Australia for 2024 which also showed December to consistently deliver a spike in spend in this quarter.

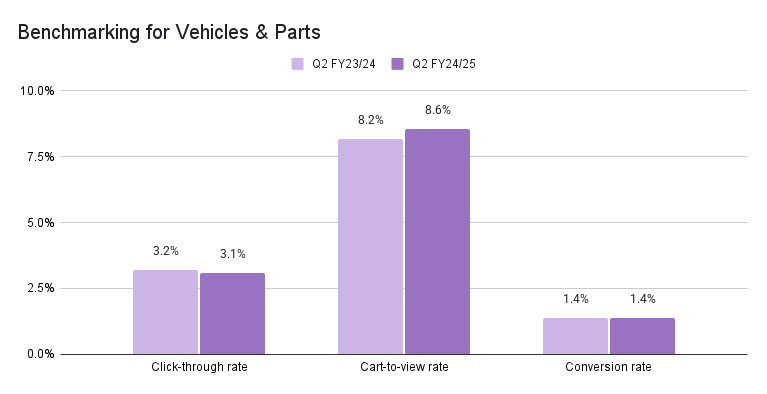

Vehicles and Parts

The vehicles and parts industry is a standout performer, with the cart-to-view rate increasing from 8.2% to 8.6%, annual comparison suggesting that more users who viewed automotive products have a lot of knowledge going into these purchasing decisions, and typically are precise in their search, specifying details such as car make, model, and year to find the exact product they need.

Additionally, the conversion rate remained stable at 1.4%, demonstrating consistency in turning visitors into paying customers despite minor shifts in click-through rates.

Megantic has 20 – 30 clients within the Vehicles and Parts space, some of them include Car Builders and OCAM Industries.

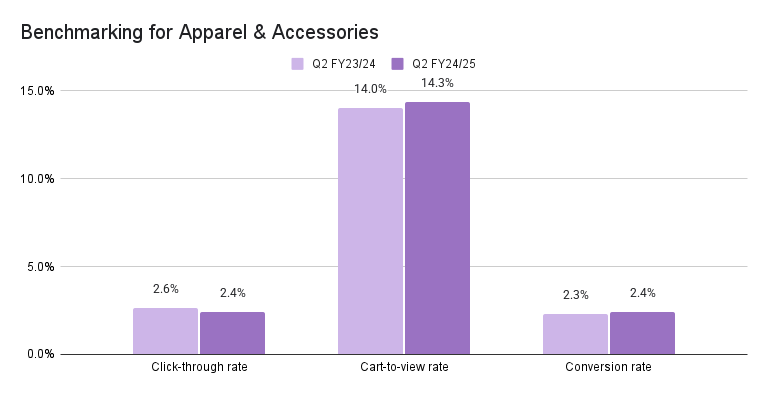

Apparel and Accessories

The Apparel & Accessories category stood out with strong improvements in purchase intent and conversion rates. The cart-to-view rate increased from 14.0% to 14.3%, while the conversion rate improved from 2.3% to 2.4%; shoppers are frequently viewing similar products. The click-through rate in this sector saw a slight decline from 2.6% in Q2 FY23/24 to 12.4% in Q2 FY24/25.

We’ve seen this category to be one of the most competitive in eCommerce, likely due to strong consumer demand, the presence of both global and local brands.

Megantic has 20 – 30 clients within this category, some of our clients include Aquila, Ripe Maternity and Louenhide.

Arts and Entertainment

The arts & entertainment sector is performing well for FY 25 Q2, with the cart-to-view rate improving from 11.5% to 11.9% and the conversion rate increasing from 2.0% to 2.1%. The click-through rate in this sector saw a slight decline from 1.5% in Q2 FY23/24 to 1.4% in Q2 FY24/25.

While economic pressure creates uncertainty in the general eCommerce landscape, the demand for arts and entertainment in our data shows a healthy market and signs that Australians are spending over discretionary activities.

Megantic has between 10 – 20 clients in this space, some of them include Monte Mart, Montana Colours and Riffs and Licks.

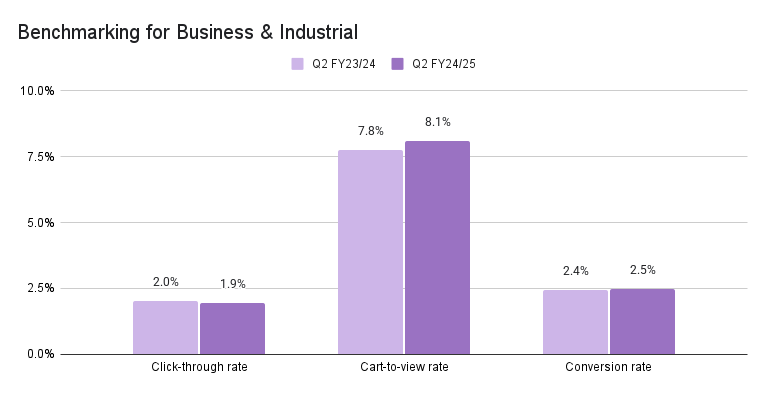

Business and Industrial

Business & industrial clients at Megantic enjoyed a strong surge in click-to-view rates, increasing from 7.8% to 8.1% year-over-year this quarter. This metric is crucial to organic engagement, traffic quality, and conversion rates, as result of this uplift in Click-to-view, we have seen an incremental improvement in conversion rates, from 2.4% to 2.5%. While a slight drop in click-through rate, a decline from 2.0% in Q2 FY23/24 to 1.9% in Q2 FY24/25.

Megantic has between 10 – 20 clients in this space, some of our clients in this category include MHA Products and Direct Wholesale

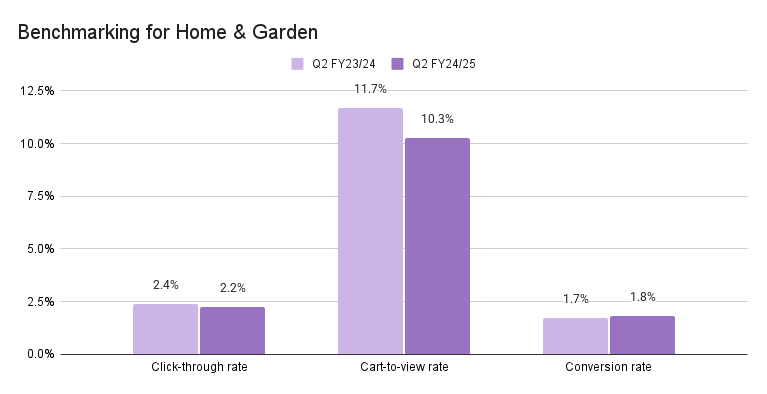

Home and Garden

In the Home & Garden sector, the conversion rate increased from 1.7% to 1.8%, reflecting improvements in targeting and the overall sales funnel. Although the cart-to-view rate and Click-through rate saw a decrease between FY23/24 and FY24/25. For garden-related clients, we know that the hobby is seasonal and Spring is the peak period when many enthusiasts take up their tools and plant things. The busy months of October and November, combined with end-of-year sales, likely contributed to the 1.8% conversion rate, an increase from 1.6% in the previous quarter.

Megantic has between 20 – 30 clients in this niche, some of them include Black Mango and Outdoors Domain.

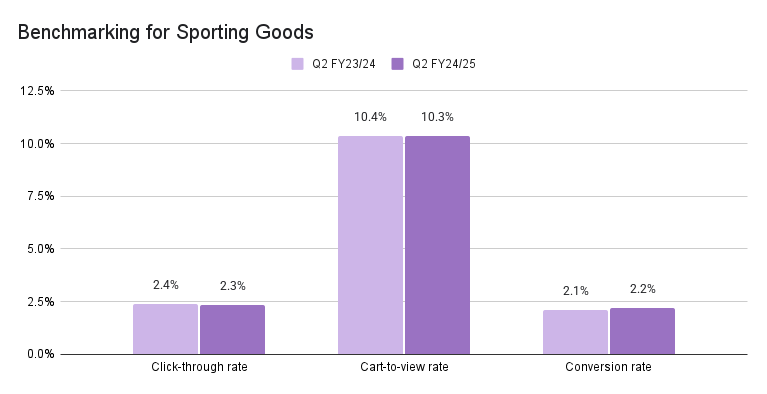

Sporting Goods

For Sporting Goods, the conversion rate improved from 2.1% to 2.2%, indicating better checkout efficiency and stronger buyer confidence. While the cart-to-view rate remained relatively unchanged, this stability suggests continued interest and engagement with products, maintaining a strong foundation for future growth.

The cart-to-view rate rose from 9.64% in October to 10.74% in November, then slightly dipped to 10.65% in December, while the conversion rate steadily increased from 1.77% in October to 2.33% in November, reaching 2.54% in December.

Megantic has between 10 – 20 clients in this space, some of them include House of Golf and Twelve Boards Store.

Key Takeaways

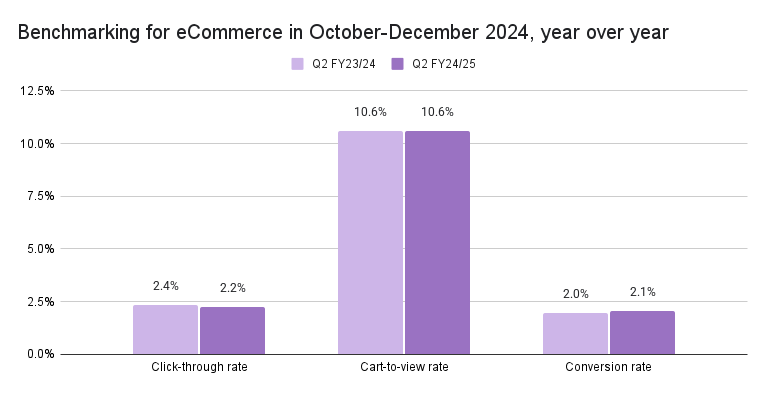

The most notable trend observed between Q2 FY23/24 and Q2 FY24/25 is a decline in the average click-through rate, which has dropped slightly from 2.4% to 2.2%. This shift aligns with broader consumer confidence trends in Australia. Mirroring other sources on consumer confidence in Australia. With market and economic forces driving new consumer values and behaviours, a Shopify report on Australian retail in 2024 reveals that 79% of Australians are cutting down on expenses to save money.

Despite this, the cart-to-view rate has remained stable at 10.6%, indicating consistent shopper interest in product pages. Conversion rates have seen a slight yet positive increase from 2.0% to 2.1%. This suggests that while overall online engagement has slightly declined, the traffic quality has improved, leading to a stronger transactional intent. The ability of traffic to convert at a higher rate compared to the previous financial year reinforces that online shoppers are becoming more deliberate in their purchasing decisions.

Lastly, December continues to be a highly profitable month for online retailers, affirming the seasonal strength of eCommerce during the holiday period These shifting priorities reflect a changing retail landscape where consumers are becoming more selective, yet still engaging in high-intent purchases.

Categories like Apparel, Home & Garden, Arts & Entertainment and Business & Industrial show significant jumps in cart-to-view and conversion rates when compared to last year’s data.